This article highlights the problems faced by a lot of projects around the Caribbean that went bust taking millions of investors money with it.

Vacation homes typically conjure up dreams of blue skies, pristine sand and crystalline waters. But for Richard Cichanowicz, buying property in paradise has become a nightmare.

In 2005 and again in 2007, the Reston, Va., program manager paid deposits for condominiums to be built at the Westin Roco Ki Beach & Golf Resort on the Dominican Republic’s eastern shore. Years later, the resort languishes unfinished and out of money. Mr. Cichanowicz still is waiting for his condos to be completed, or for his deposits—totaling $675,000—to be refunded.

“We had visions of family vacations and inviting friends there,” Mr. Cichanowicz says. “All of that has just been put on hold, seemingly indefinitely.”

Caribbean vacation-home buyers, most of them American, have been learning a costly lesson: Unlike in most U.S. states, deposits in most Caribbean countries can be spent on construction rather than locked away in escrow.

That has posed big problems for would-be buyers at no fewer than six Caribbean resort projects whose developers ran out of money during construction, as the economic downturn caused sales to plunge and funds to dry up. Those stalled projects include the Westin Roco Ki, a Four Seasons in Barbados and a Ritz-Carlton in the Turks and Caicos Islands. A seventh resort, the Viceroy Anguilla, was completed but then foreclosed upon before villa sales closed.

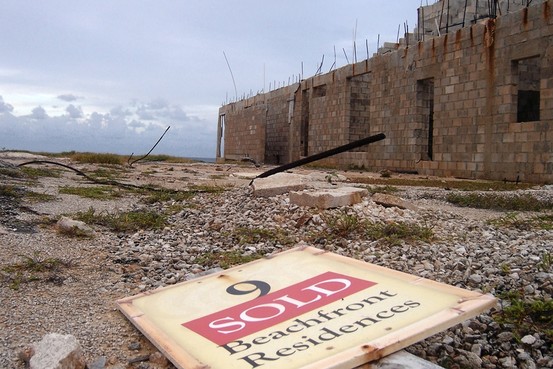

At those seven projects, buyers paid roughly $300 million in deposits for vacation homes that in most cases still languish as partial structures of cinder block and rusting steel bars.

The woes of these troubled projects have cast a pall over the business model that spurred one of the Caribbean’s largest resort-development waves in recent decades. “That model is dead for the next three to five years,” said Rick Newton, founding partner of Resort Capital Partners LLC, an investment adviser specializing in Caribbean lodging.

Buyers have no hope of getting their money back from the major hotel companies whose names are attached to the projects—like Four Seasons, Ritz-Carlton and Westin—because the companies simply manage and brand the hotels while developers sell the residences.

Representatives for Four Seasons and Westin parent Starwood Hotels & Resorts Worldwide Inc. say they are disappointed in the status of the projects, and Starwood Hotels noted that hotel operators aren’t responsible for the overall development. The Four Seasons spokesman added that in order to protect its brand and any buyers of Four Seasons-branded residences, the company has new conditions for prospective developers to meet. Ritz-Carlton declined to comment.

Rob SterlingThe developers and lenders of the stalled Westin Roco Ki resort are looking for new investors in order to resume construction.

One hope for buyers is that the cash-strapped developers obtain new financing or that a new investor steps in and returns their deposits. Another possibility: Anyone taking over the developments might want villa buyers to complete their purchases in order to give builders additional funds to finish construction.

“This project will never get done unless the original buyers participate in it,” says Mike Carretta, a New Jersey advertising executive who paid a $1.4 million deposit for a still-incomplete vacation home at the Temenos resort in Anguilla. “You’re just not going to go out in this economic climate and find 30 new buyers for property like this.”

Complicating matters, debt financing has always been tough to obtain in the Caribbean and some of the developments are tangled up in legal battles.

Also, many of the developments have deteriorated amid harsh Caribbean weather conditions, so restarting them would be expensive. At the Westin Roco Ki, for example, jungle vegetation was retaking the grounds and debris littered the beach when visited by a Wall Street Journal reporter late last year.

The project’s developers and lenders are marketing it for sale and have drawn interest but not a final deal yet.

“Most villa buyers are hoping that a white knight will show up and finish their villa,” says Matt Norton, an attorney specializing in Caribbean resorts for U.S. law firm K&L Gates LLP. “But the reality is that, with most of these guys, the money is gone.”

The phased-payment plans in the Caribbean typically required a buyer to pay a deposit upon signing a contract. The buyer would then pay more when construction milestones were met, with the balance due at closing.

Buyers say the practice of using deposits for construction was highlighted in most sales contracts, but they didn’t expect the projects to grind to a halt.

“I had never purchased an island home before and should have been more careful,” says Mr. Carretta, who visited Anguilla often to monitor progress of his villa’s construction.