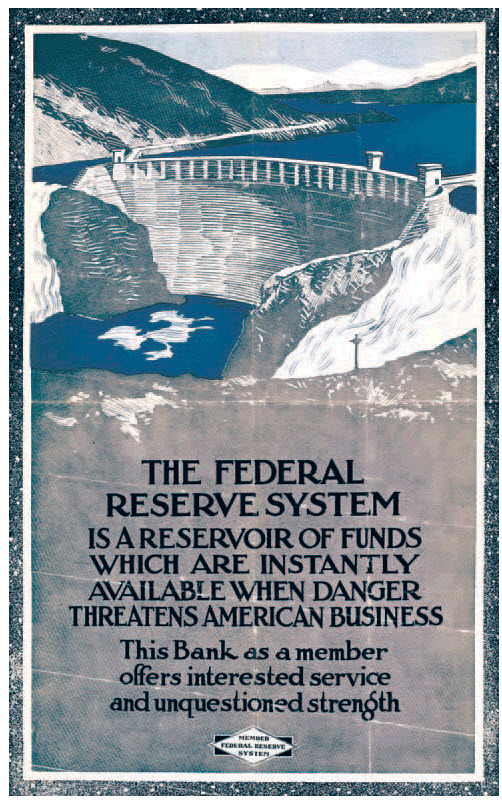

I just love these old propoganda posters that we put out years ago to convince people that the Greater Depression would never happen.

Unlike the United States, Panama does not have a Central Bank and while the US Dollar is the currency here, inflation for the most part has remained very low over the last 20 years. Unfortunately our paper currency is still the US Dollar and because of loose economic policies elsewhere, we may be in for a change in the rate of inflation in the coming years. Decoupling and the difficulty involved in doing so is not the answer but perhaps another legal tender could be added. Here is what Switerland might be doing in the future.

The Swiss Parliament is expected later this year to discuss the creation of a gold franc. “I want Swiss people to have the freedom to choose a completely different currency,” said Thomas Jacob, the man behind the gold franc concept. “Today’s monetary system is all backed by debt – all backed by nothing – and I want people to realize this.”

Anyway, here is a piece in Economia that was written by Diego E. Druan Quijano on how Panama has fared over the years.

Opinion. Panama greets the year 2011, this the 108th year without a central bank. Choose any neighboring country, check your economic history and see that there is reason to celebrate. To begin, for a century we have saved costs in wages and real estate amongst other things. . In addition, politicians have been forced to control spending by not having a central bank that will cover the deficit with money creation. (FIAT!)

The result of a higher caliber financial system has been price stability. To give you an example, while the rise in the Consumer Price Index (CPI) in Panama between 1990 and 2005 was 19.03% in Costa Rica it was 790.64%.

Put another way, what in 1990 cost $ 100 in Panama cost $119 in 2005 and cost $ 890 in Costa Rica!!

In 1980, Panama suffered the worst rise in the price level, an increase of 13.8%. The year in Brazil, prices surged 110%. While the rise in CPI in Panama averaged 3% between 1961 and 1997, in Brazil between 1990 and 1995 increased 764% each year.

Price stability has given the residents of Panama a more financially secure nation than most neighboring countries.

Economist José Joaquín Fernández explains that “the absence of monetary authority in Panama, the amount of dollars circulating in the economy depends solely on the productive sector. It is through the free supply and demand for dollars which regulates monetary stability of Panama.”

But now the dollar is suffering due to the damages of political management and we feel the rising gasoline prices and other imports.

Miguel Verzbolovskis could not have said it more succinctly and clearly: having the dollar has been a cyclical advantage of long life, but no central bank has been a structural and institutional advantage that we must protect.