There are few better places to run Procter & Gamble’s growing Latin America business than the Costa del Este neighborhood of Panama City.

A mix of corporate offices and highrise residential towers on the edge of the Pacific, it’s attracting a diverse set of international companies, including 3M, AES, Nestle and Samsung.

“In Panama we have found a business-friendly environment with an open-door policy,” says Juan Fernando Posada, P&G’s president for Latin America.

The Central American nation is best known for its eponymous canal, a majestic symbol of global trade, through which flows 5% of all the world’s goods. But Panama is much more than just a place to pass through, as its central location, modern trade infrastructure and economic and political stability have

combined to create a strong draw for foreign businesses seeking to build regional trade operations or manufacturing hubs.

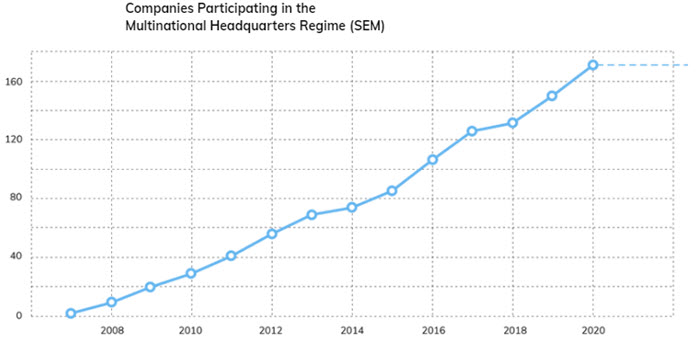

In 2007, Panama’s legislature passed a package of corporate tax, labor and immigration benefits that have led 175 multinationals to establish regional headquarters in Panama, accounting for $1.2 billion in investment. In a sequel of sorts, in February, Panama enacted a second set of rules that extended those

benefits from headquarters operations to manufacturing facilities.

Procter & Gamble was the first multinational firm to move its Latin America headquarters to Panama under the 2007 Multinational Headquarters regime (known locally as the SEM regime, per its acronym in Spanish). Multinationals locating regional headquarters in Panama pay reduced income taxes for

services rendered, and zero dividend taxes. “It makes it easier for multinational companies to bring their executives and trusted personnel to Panama,” says Ramon Martinez de la Guardia, Panama’s Minister of Commerce and Industries.

For P&G, relocating 500 families to Panama from several Latin American countries “was a big challenge, but we got a lot of support to make it as smooth as possible,” says Procter & Gamble Senior Vice President Carlos Giraldo

His Excellency Mr. Laurentino Cortizo CohenPresident, the Republic of Panama

His Excellency Mr. Laurentino Cortizo CohenPresident, the Republic of PanamaPanama City’s Tocumen International Airport is considered the hub of the Americas, with 90 connections to 34 countries. Any location in Central America, Colombia and Venezuela is one to two hours away; Miami is three hours away; and many U.S. and South American locations can be reached in under six hours. The airport is located so conveniently within Panama City that Giraldo leaves his home at 9 a.m. to catch a 10 a.m. flight.

Panama also boasts five other airports, five major seaports (including the busiest container port in Latin America) and a railway that functions as a dry canal, connecting the Atlantic to the Pacific.

Since 2008, science-based technology company 3M has had a factory, logistics hub and operations center in Panama. “Our access to raw materials is much faster than in other places in Latin America, and it’s an ideal place to consolidate and export merchandise to our distribution centers in the region,” says Enrique Aguirre, Director of 3M for Central America and the Caribbean. “It’s also easy to distribute to Central American countries by land.”

The underlying political and economic infrastructure that keeps commerce flowing smoothly is just as essential as all the cranes and vessels in Panama’s ports. Panama has enjoyed free and fair elections for more than 30 years, and has a dollarized economy with almost no inflation over the last century. Supported by a well-developed international banking system, the nation’s economic growth hovered around 7% for 15 years prior to the Covid crisis, leading the rest of Latin America.

“Legal stability is very important—you have to compare that to the rest of the countries in Central and Latin America,” says Aguirre. “The rule of law is clear. And U.S. companies feel very comfortable here, perhaps because of the history the two countries share.”

The global trade outlook has clouded in recent years, as tensions have grown between the U.S. and China and various disasters have disrupted supply chains. As a protective measure, more global companies are nearshoring—moving manufacturing closer to places where the goods will be sold.

In February, Panama enacted regulations for the new Manufacturing Services for Multinationals regime, locally known as EMMA, “to take advantage of the nearshoring trend,” says Minister Martinez. EMMA brings the tax, labor and immigration benefits of SEM to global manufacturers, and eligible companies are exempt from taxes, fees and import duties on all goods and raw materials.

For Asia-based companies, Panama is an ideal location to finish products for export to Latin America, North America or Europe, and American companies can use Panama to finish products for export to Latin America, Europe or Asia. In either case, EMMA offers incentives for manufacturing, logistics services and R&D, just as SEM did for so many corporate headquarters.

Since the EMMA regulations took effect in February, Martinez has already fielded inquiries from 10 companies for manufacturing operations in industries including pharmaceuticals, automotive assembly and cosmetics.

When 3M built its factory in 2008, “there wasn’t too much manufacturing in Panama,” says Aguirre. Since then, 3M has trained an entirely local workforce for the factory, which produces car care solutions for the global market. “More companies have established here, and now, with EMMA, there is a great incentive to attract more,” he says.

EMMA also incorporates new labor provisions that allow partners and spouses declared under either regulatory regime to obtain permits to legally work in the country using their same special migratory visa.

Even before EMMA took effect, South Korean electronics giant Samsung chose Panama City as its operational hub for Central America, the Caribbean, Ecuador and Venezuela. Its new depot in the Panama Pacifico zone will ship spare parts to all of Latin America.

“Panama has been successful in establishing a robust institutional framework and a favorable economic environment that enable businesses like ours to grow,” says Jae Hoon Kim, chief executive of Samsung’s Panama and Zona Libre subsidiaries. “The economic and political stability, strategic location, and

Many cities and countries have lured global business leaders to their shores, but the real test is whether they stay. At P&G, about two-thirds of their non-Panamanian employees have lived in Panama for more than five years, a sure sign of their comfort level with the country. “Panama offers good medical services, financial stability and a wide range of real estate options,” says P&G’s Giraldo. “And in recent years, the number of international schools has significantly increased.”

“I am a huge ambassador for Panama,” says Giraldo, a native Colombian. “I am considering living here when I retire.”

“The country offers us so many benefits in terms of logistics, geographical location, legal security, quality of life, access to services, quality health and housing and trained professionals,” adds Juan Gabriel Reyes, President and CEO of Nestlé Central America, which has two factories and its Central American regional offices in Panama.

“In turn, we provide the country with highquality job opportunities, transfer of knowledge, tax payments and consumption of its products and services,

Stay Safe!!