This is a great article by Sam Instone and AES International, offshore financial planning specialists.

Researchers from New York’s Cornell University discovered that most Americans believe pretty much any lie, as long as it’s visually supported by a scientific looking chart.

They published the following findings in the journal the Public Understanding of Science:

“In a series of three experiments, researchers showed study participants different versions of a description of a cold medicine. Of the group that saw the description with an effectively useless chart, 97 percent believed the medicine was efficient, compared to 68 percent of the group that read only words, with no graphic.”

Conceivably therefore, if we want to make an American believe a lie all we have to do is this: –

Why expats are vulnerable to lies

- As an expat you’re vulnerable to being sold lies – with or without charts

- What’s worse, you’re likely to believe the lie because of the conviction of the person telling it, and repeat the lie to other expats

- This results in a vicious circle of misinformation

Expat Jerry Jones from The Culture Blend blog explains why expats are so vulnerable to misinformation:

“In human years expats move from 5 to 16 in about two months.

Let me explain.

Expats are über inquisitive on the front end.

“What is that? How do you say this? What’s that smell? Why do they do that? What’s the history behind this? Who? What? When? Where? How? Why? Why? Why?

Just like a 5 year old.

We embrace ignorance on a quest for answers.

BUT (and this is where it ALL falls apart): We think when we get an answer we understand it (you should read that sentence again). Soon we “know” (finger quotes) everything.

Just like a 16 year old.

When we have answers we stop asking questions.

This can be a fatal flaw for expats.

There is ALWAYS more to it.”

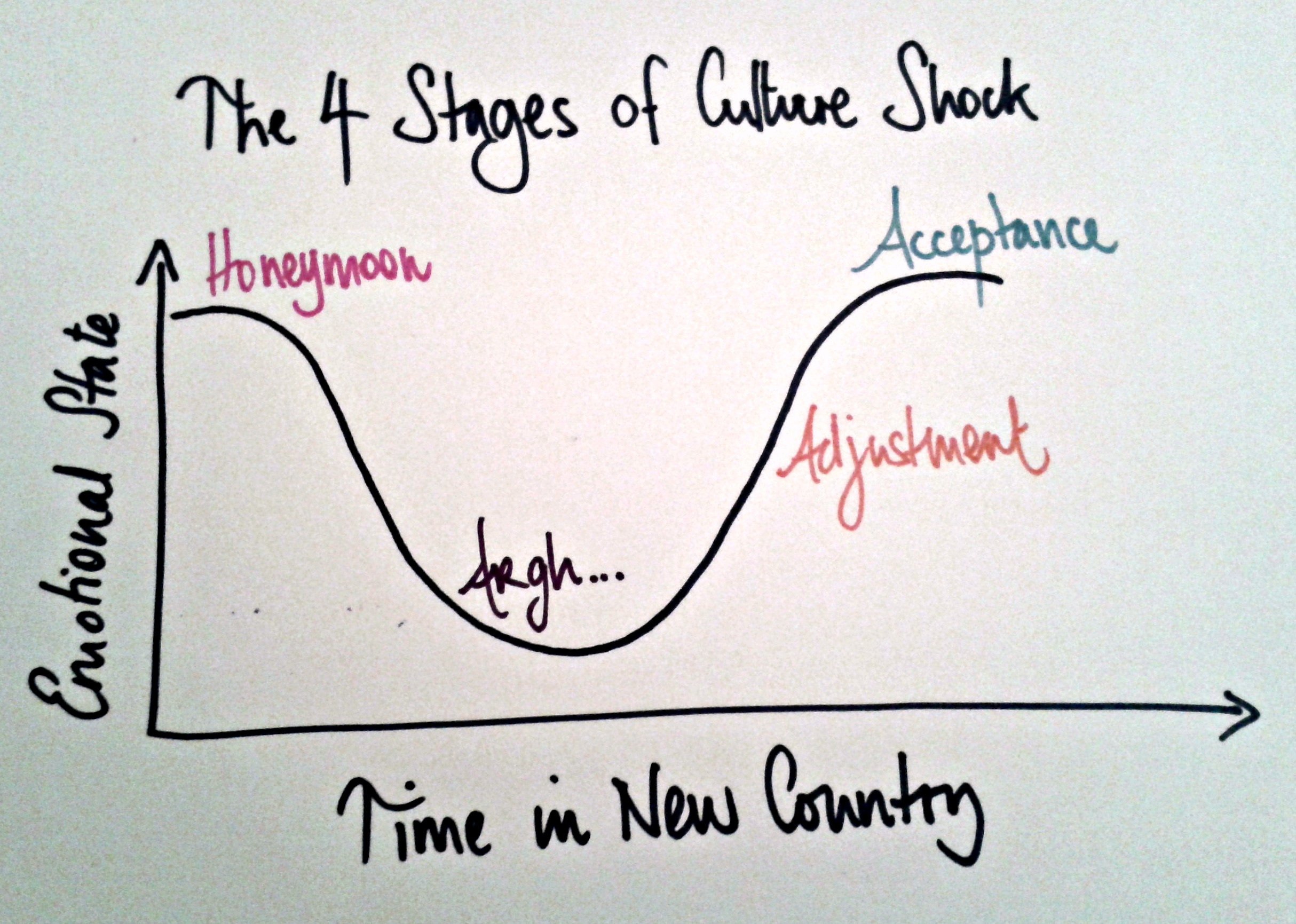

Innocent lies many expats are told

- Everyone speaks English

- There’s no such thing as culture shock

- Every day is like a holiday

Dangerous lies expats are led to believe

- Expat financial advice is ‘free’

- Expats can get guaranteed investment returns

- Offshore plans are flexible, tax free and represent the best way for expats to save

And just one more for good measure…

- Your expat IFA is a really nice person, acting in your best interests, as any friend would. You don’t even have to pay him! Just repay his kindness by referring him and his ‘free’ advice to all your friends…

Free checklist: How to choose a financial adviser »

The truth behind the dangerous lies

Stop the vicious circle of misinformation by redirecting anyone who believes the above lies here: –

However, because the commission that financial salespeople get isn’t disclosed, expats choosing ‘free’ advice usually don’t know how much they’ve paid.

The alternative is to choose a fee-based financial adviser whose fees are disclosed up front.

- Investments marketed by many offshore financial salespeople as having guaranteed returns are actually the most complicated, opaquely confusing and high-risk products on the market.

Structured Products and Unregulated Collective Investment Schemes are mostly rubbish; exposure to them often leaves you short changed.

Much better alternatives exist delivering improved returns, lower costs and less risk.

- Offshore savings plans, pensions and bonds all sound so innocent. In fact, they sound like the answer to many an expat’s prayers.

After all, they help expats make the most of their time abroad financially by committing them to saving a set amount each month, over a set term – right?

Wrong!

Certain savings plans, (also sold as offshore pensions, offshore savings plans and regular savings accounts for things like school fees planning), are easily misrepresented by financial salespeople.

In the UK, some of these types of plan were banned because they’re often associated with high-pressure sales techniques.

Many have opaque and expensive charging structures too, and pay those who sell them huge commissions.

Once sold, there is then little incentive for the salesperson to continue working with you, because they will have received their fat commission cheque already.

And just one more for good measure…

- Choosing a financial adviser because they are nice is the most common mistake we come across.

Just because an adviser:

- belongs to the same club or goes to the same pub as you

- is a friend of a friend

- is advising others at your company already

That doesn’t mean they are a gifted investment adviser.

It doesn’t guarantee they are a qualified, licensed and regulated professional, who is legally required to adhere to a code of ethics either.

The terms ‘financial adviser’ or ‘IFA’ are used all too frequently offshore. The onus is on you to do your due diligence and check out their credentials.