Why save the best paragraph for the last!!

The move comes after the release last month of the Panama Papers, millions of documents that revealed the use of anonymous offshore shell companies. The leak, obtained from Mossack Fonseca, a Panamanian law firm, sparked an international outcry and exposed the Central American country to the threat of potential blacklisting.

The Paris-based Organisation for Economic Co-operation and Development announced on Wednesday that Bahrain, Lebanon, Nauru and Vanuatu had, together with Panama, promised to share financial account information automatically with other countries.

The countries were the last remaining holdouts against the international transparency initiative with the exception of the US, which operates under different rules.

Angel Gurría, secretary-general of the OECD said: “We are now seeing an unstoppable movement toward information sharing, on the basis of a single common standard developed by the OECD and endorsed by the international community.

Promises made by countries “must be turned into practical reality, through implementation of the standards and actual exchange of information”, he said.

The latest announcement means that 101 countries have agreed to collect and exchange information on bank accounts by September 2018, even if they have to identify the owners of companies and trusts to do so.

But it also represents the second time Panama has agreed to sign up to the initiative known as the common reporting standard.

In February the OECD said Panama had gone back on an earlier commitment, insisting that it wanted to “work towards automatic exchange of information” on its own terms, rather than keeping to the common reporting standard.

A meeting of finance ministers from the G20 group of leading economies increased pressure on the country last month by warning of “defensive measures” against non-co-operative jurisdictions.

Economists call for end of tax havens

Pressure on Cameron mounts ahead of anti-corruption summit

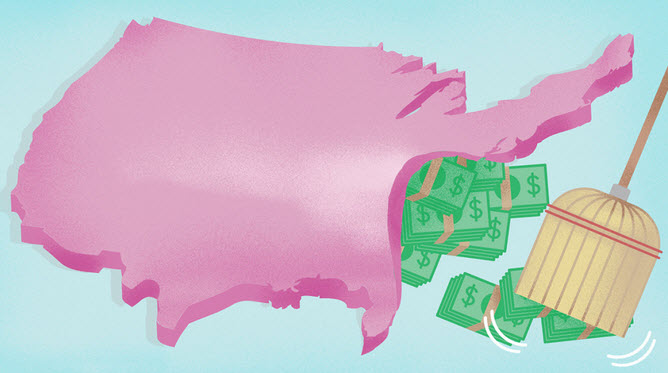

Wednesday’s announcement may shift attention to Washington which shares information with other jurisdictions on foreigners who have US bank accounts, but does not automatically exchange data on accounts held by companies and trusts.

The White House says has urged Congress repeatedly to legislate for “full reciprocity” on such information exchange, arguing that “ensuring that we live up to our end of the bargain” would strengthen the US in pressing other countries to improve transparency.