It looks like Panama Petrochem Limited (NSE:PANAMAPET) is about to go ex-dividend in the next three days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company’s books to be eligible for a dividend payment. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn’t show on the record date. Accordingly, Panama Petrochem investors that purchase the stock on or after the 27th of August will not receive the dividend, which will be paid on the 6th of October.

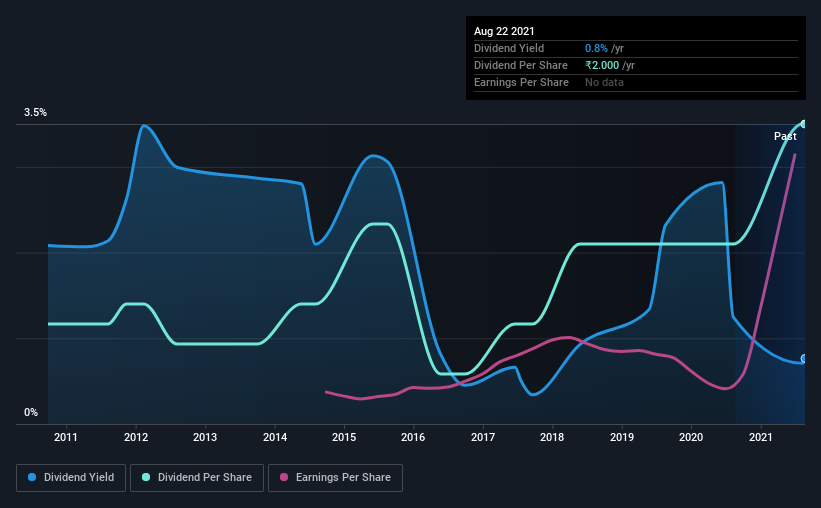

The company’s next dividend payment will be ?2.00 per share. Last year, in total, the company distributed ?2.00 to shareholders. Looking at the last 12 months of distributions, Panama Petrochem has a trailing yield of approximately 0.8% on its current stock price of ?263.05. If you buy this business for its dividend, you should have an idea of whether Panama Petrochem’s dividend is reliable and sustainable. So we need to investigate whether Panama Petrochem can afford its dividend, and if the dividend could grow.

See our latest analysis for Panama Petrochem

If a company pays out more in dividends than it earned, then the dividend might become unsustainable – hardly an ideal situation. Panama Petrochem paid out just 6.4% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. A useful secondary check can be to evaluate whether Panama Petrochem generated enough free cash flow to afford its dividend. What’s good is that dividends were well covered by free cash flow, with the company paying out 24% of its cash flow last year.

It’s encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don’t drop precipitously.

Click here to see how much of its profit Panama Petrochem paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it’s easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. That’s why it’s comforting to see Panama Petrochem’s earnings have been skyrocketing, up 50% per annum for the past five years. With earnings per share growing rapidly and the company sensibly reinvesting almost all of its profits within the business, Panama Petrochem looks like a promising growth company.

Another key way to measure a company’s dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, Panama Petrochem has increased its dividend at approximately 12% a year on average. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

The Bottom Line

Is Panama Petrochem worth buying for its dividend? It’s great that Panama Petrochem is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. It’s disappointing to see the dividend has been cut at least once in the past, but as things stand now, the low payout ratio suggests a conservative approach to dividends, which we like. It’s a promising combination that should mark this company worthy of closer attention.

On that note, you’ll want to research what risks Panama Petrochem is facing. Case in point: We’ve spotted 2 warning signs for Panama Petrochem you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

Get Vaccinated and stay safe!!