The Panama Canal’s enlargement has enabled it to win back most of the all-water traffic between Asia and the US East Coast that it had lost to the rival Suez Canal route.

The Central American waterway’s share of the total headhaul capacity on the route has risen to 74 percent, the level it had in 2010, after slumping to 48 percent at the beginning of 2016, according to Alphaliner.

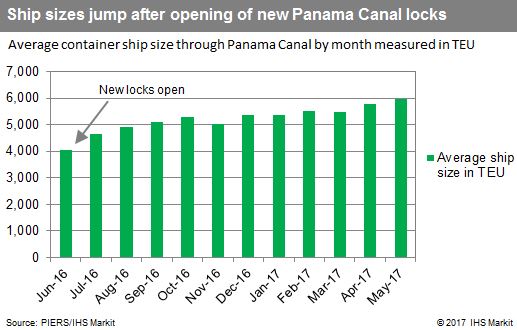

The opening of the new locks in June 2016 shifted the advantage back to the Panama Canal as the larger neo-Panamax and sub neo-Panamax ships, now able to transit, helped lift average vessel size to the same as on the Suez route, the industry analyst says.

The Egyptian waterway has, however, retained the headhaul and backhaul legs of five all-water services, while five services that use the Panama Canal on the headhaul direction, return to Asia via the Suez Canal.

The battle between the two waterways is continuing, with the Panama Canal Authority planning to cut tariffs for neo-Panamax vessels from October 1.

“These will however only apply to backhaul voyages to Asia – a move clearly aimed to drawing back the Suez Canal services,” Alphaliner notes.

However, the reductions are relatively modest, at only 6 to 12 percent, and may not be sufficient to entice carriers to reroute their backhaul services via the Panama Canal.

The Suez Canal Authority has also extended its 45 to 65 percent rebates on toll tariffs for a further six months to the end of the year, which should ensure it retains some of the traffic for the time being.

The Panama Canal tariff reductions will benefit the nine existing services transiting the waterway on both legs with weekly savings of up $400,000 for the carriers, based on estimated weekly discounts of $40,000 to $50,000 for each service.

Neo-Panamax ships, with 19 rows of containers, and sub neo-Panamax vessels, 16 to 18 rows, made 795 voyages, or 50.5 percent of all transits, through the expanded Panama Canal during its first year of operations.

The number of 16- to 19-row container ships sailing through the canal is likely to almost double in the coming year, with around 1,400 transits, Alphaliner said.

Fifteen weekly services currently transit the Panama Canal of which nine make a return voyage, for a total of 24 passages.

At least two carriers are planning to launch new Asia-US East Coast services next year, which could significantly increase transits through the waterway, while five current trans-Panama services deploying classic 13-row vessels of 4,000-5,100 TEU capacity could be up-sized in the coming year, further boosting traffic of larger vessels.

Contact Bruce Barnard at brucebarnard47@hotmail.com.