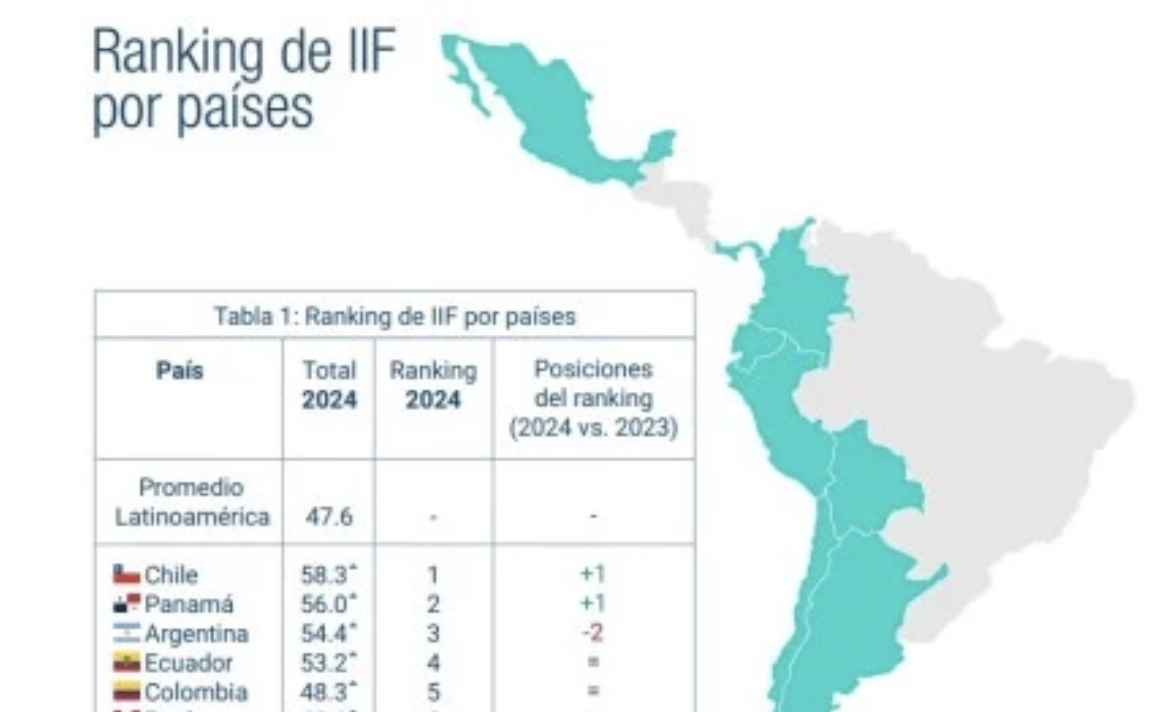

The fourth edition of Credicorp’s Financial Inclusion Index (IIF) revealed that Panama is the second country in Latin America with the highest score in this index, advancing one place compared to 2023.

The report highlights that Panama’s rise is mainly due to an increase in the holding of credit products within the financial system and the growing use of banked means to make transfers and receive income, these factors have contributed to strengthening the country’s presence in the regional financial field.

However, despite the progress, Panama reports the worst perception of security among the countries evaluated. The fear of transacting through digital channels, such as mobile wallets or banking applications, remains a latent concern among the population.

Although this result reflects progress, the report also reveals important gaps that mainly affect the most vulnerable groups in the country.

The study uses a scale of 0 to 100 to measure the level of financial inclusion, and the results can be analyzed according to the level of education, occupation, internet access and sociodemographic characteristics.

These variables allow us to identify the social groups in which achievements have been achieved and those where it is necessary to focus greater efforts to reduce existing gaps.

The IIF highlights that, as in 2023, the largest gap in financial inclusion in Panama is related to the educational level: Panamanians with postgraduate studies reach a level of financial inclusion of 71.1 points, compared to 21.2 points for those without studies, which reflects a difference of 49.9 points between both groups.

The report identifies differences in terms of occupation and internet access. For example, in the case of dependent workers, their level of financial inclusion reaches 67 points, while the unemployed barely reaches 38.2 points, reflecting a gap of 28.8 points.