Jeff Thomas writes in Doug Casey’s International Man magazine a good article about the reason and timing of internationalizing.

More than ever before, people are seeing the writing on the wall and are leaving their home countries. They’re seeking a fresh start in countries that seem less likely to be headed over the economic, political, and social cliff. Nowhere is this more true than in the US. The official estimated number of annual renunciations in the US has been around 3,000, but reports suggest that that number is far below the actual number.

Secondary to the group of people who are eagerly pursuing their expatriation is a group who have figured out what’s coming but have chosen to treat the move with less urgency. They are hoping to make their move when it becomes convenient to their situations. Here are a few commonly voiced reasons they give for their delay.

“I can’t go right now—the kids are still in college.”

“I’m just two years away from full retirement. I’d like to have the extra money.”

“Granny doesn’t have long to go. We’ll just wait until she’s gone, then leave.”

Their timeline is based upon events at home, and they’re hoping that the collapse in their countries will wait until it’s convenient for them.

The likelihood of this is nil. The house of cards has never been shakier and it’s getting worse by the day. When will the various crashes begin? A year from now? Six months? Tomorrow? We can only guess, but what we can be sure of is that, whilst the events may not be imminent, they are inevitable.

But more important, those who are placing a date a year, two years, or more in the future for their internationalisation tend to focus on the present, rather than the future. That is, they’re assuming that the present conditions will conveniently remain in effect until they’re ready to go. In fact, quite the opposite is true. As events unfold, failing governments will become ever-more restrictive. In some cases, this will mean that the expatriation will become more difficult, more expensive, or both. And for many, it may render expatriation either unworkable or impossible.

Let’s take a look at a few developments that, in the near future, may limit the chances of making an exit:

Capital Controls

The EU, US, and Canada have now passed bail-in legislation. This means that, at some point, deposits will likely be confiscated by banks in these jurisdictions. Governments are also making the early moves to require that retirement funds invest substantially in government treasuries—an extremely dodgy prospect.

Exit Tax

The media are presently describing the movement of money toward privately held funds overseas as “the injustice of people abandoning the country.” In fact, Bloomberg Businessweek recently stated, “Exiting the country with all that property should surely count as theft.” The rhetoric is increasingly that exiting from a country that oppresses you is unpatriotic, if not criminal.

A 15% exit tax is now in place in the US, which is being considered for an increase to 30% and could, of course, be increased further. This is essentially a capital gains tax, as if you had sold everything you own when you left. (Presently, there are exemptions, but they may be eliminated at a moment’s notice.)

Passport Restrictions

Passports can now be suspended if the person’s tax compliance is “in question.” “In question” is, of course, intentionally very broad and can mean anyone, not just someone who is presently under an audit. It would not be surprising if, at some point, permission to travel might become a requirement.

The citizenship renunciation fee has increased by more than 420% in the last year. (It is already 2,000% of what it is in other high-income countries.)

Overseas Home Prices Become Unaffordable

As more people move to other countries, real estate prices will climb beyond their present levels. In those countries where large numbers arrive, prices will rise the most.

Overseas Job Markets Dry Up

Typically, job opportunities for First-Worlders in other countries are very good, but as the flood of expatriation increases, this will either diminish or, in some countries, end.

Doors Closing

Those expatriating tend to assume that they will continue to be as welcome in other jurisdictions as they are now, but some countries that previously kept the welcome mat out for new residents are increasingly placing limits on new applicants and may soon pull in the welcome mat altogether.

Gold Unavailable for Sale

One of the few safe havens for wealth that’s left today is precious metals. Many people who plan to exit assume that, at some point, they will buy gold and silver to protect themselves. However, it’s safe to say that we’re getting much closer to a paper-gold crash.

Recently, we’ve seen a COMEX situation in which twenty ounces of gold had been contracted for each ounce available. This is unquestionably unsustainable, and at some point, buyers will realise that the emperor has no clothes. The paper-gold crash, like the other coming crashes, will occur suddenly. The gold mania will begin in earnest, and those planning to buy “a little later, but not now” may well find that the horse has bolted and the opportunity to buy has passed, as holders are not selling.

As Doug Casey has said, “A society can fall from grace with amazing speed.” Quite so. Any or all of the above developments are likely to occur without warning, making your internationalisation plan, “too little, too late.” So, if the kids are still in college, that does not mean that Mum and Dad cannot expatriate now, preparing the future for them elsewhere. The children can join them after graduation.

If full retirement is far enough out that you might lose more than the additional retirement amount by delaying your plan, it may be best to let it go.

If Granny seems to be hanging on, there are likely to be facilities in other countries that are equal to the one she now lives in.

These are hard realities to face. All of the above concerns are built on loyalty and responsibility to others, which is unquestionably a good thing. The question each person must ask himself is whether, by delaying a move to a date when the opportunity to move is gone, he is really being responsible to his family. Is it better to make the move now, take the hit, and be settled in a safer jurisdiction so that when things really do unravel, you are well-situated?

Again, if there is no change in the existing laws and regulations, the reader will still be all right and can leave when he wishes, as he wishes. But these laws and regulations are unquestionably not going to remain static.

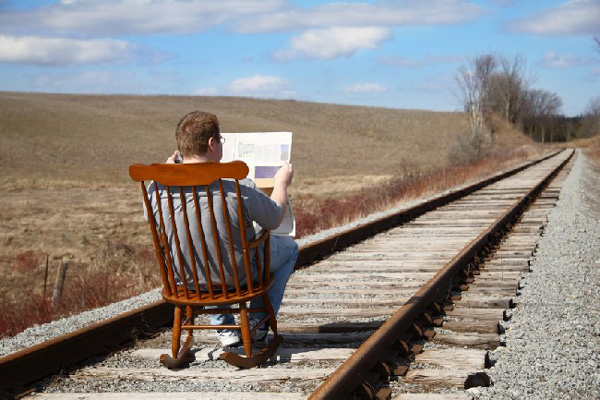

There’s a train coming down the track toward us and it’s now picking up speed. But unlike the man in the photo above, we can’t simply fold up our newspaper and take our rocker from the tracks. Internationalising takes time and those who delay may find that they’ve waited too late and have lost the opportunity for a better life.

Editor’s Note: Unfortunately there’s little any individual can practically do to change the trajectory of this trend in motion. The best you can and should do is to stay informed so that you can protect yourself in the best way possible, and even profit from the situation. That’s what International Man is all about—making the most of your personal freedom and financial opportunity around the world. Our free video crash course is a great place to start, more on that here.