Todd Ganos contributes this artile to Forbes and explains how the recent revelation of what are being called the “Panama Papers” highlights the poor advice individuals receive, irrespective of country. Key to characterizing things as poor advice for non-US persons is the recognition of the most overlooked tax haven in the world: the United States.

In this column, we’ve previously mentioned that there are two basic “regimes” of income tax law: territorial and domiciliary. Under the territorial system, only the jurisdiction that is the source of income is allowed to tax that income. Thus, if a citizen of country A receives a dividend from a company in country B, country A will not seek to income tax that dividend and only country B will.

Under the domiciliary system, only the jurisdiction that is the taxpayer’s domicile is allowed to tax income received. Thus, if a citizen of country A receives a dividend from a company in country B, country B will not seek to income tax that dividend and only country A will.

The vast majority of the world follows the territorial regime. As such, only the jurisdiction of income’s source taxes the income.

The United States is different. It follows the domiciliary regime – with some modifications. Congress understands that most other countries follow the territorial regime and will be taxing income sourced from their respective jurisdictions. So, in an effort to avoid double-taxation, the U.S. grants a foreign tax credit.

Under that same domiciliary regime, the U.S. does not tax U.S.-source income of non-U.S. persons (who do not have a substantial presence in the U.S.) The only little tweak to that general rule is that dividends and real estate income are subject to income tax. But, other than that, non-U.S. persons do not pay income tax on capital gains and bond interest.

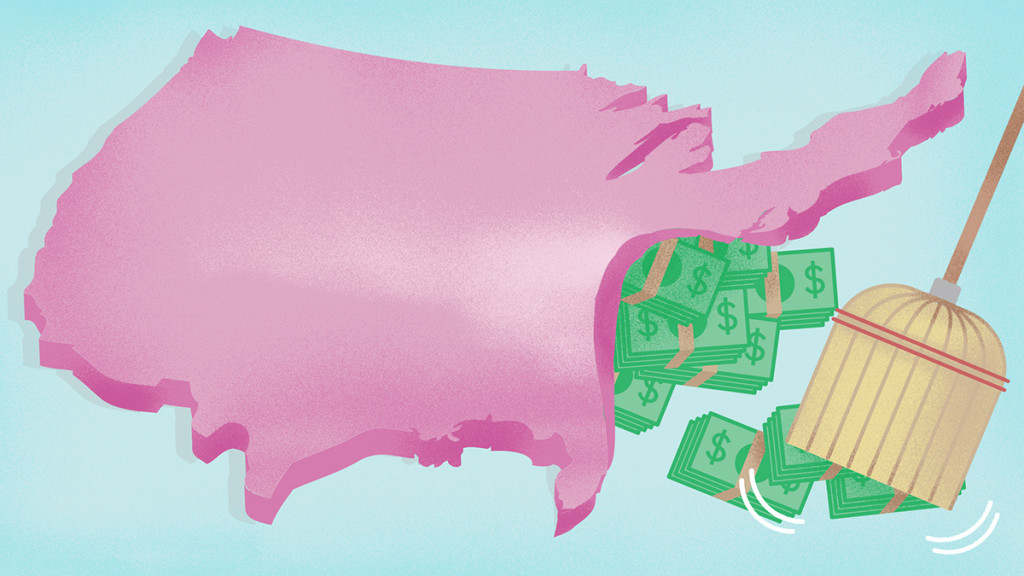

So, sparing all the nuanced language, if you are a non-resident alien, you can park your money in the United States and you will not pay income tax to the United States. And, if your home jurisdiction follows the territorial regime, you won’t pay any income tax to any jurisdiction. Pretty sweet.

Whether you’re a rich guy or an average Joe, you can do this. It all is legal. In some respects, it is no different from Apple AAPL +1.94% or General Electric GE -1.17% using the Internal Revenue Code to defer U.S. income tax on foreign-earned profits. As Apple CEO Tim Cook related, Apple has not broken any laws and Apple has paid every dollar of tax it legally owes. And, he’s right.

Now, it is a reasonable thing for a person – including a national leader of any country – to say that he/she wants to diversify his/her portfolio globally. No one would criticize the person. If the person has a brokerage account and has non-home-country stocks and bonds in that account, no one would criticize that person.

So, why does one go through all of the gymnastics in Panama? (We’ll exclude operating companies from this discussion. We’re only talking about investment accounts.) If you simply want the tax savings, you can open a brokerage account in the United States, as we noted above. You’ll get the tax savings. So, why does one need to go to Panama?

The answer is pretty simple.

The President of the United States is driven around in an American car. The Queen is driven around in a British car. The Chancellor of Germany is driven around in a German car. How would it look if any one of these heads of state were to drive up in a car from another country? There’s a certain amount of national pride.

So, if a national leader has every single penny of investment wealth in non-home-country stocks and bonds, one might conclude that global diversification is not the real issue . . . tax is the driver. And, how would it look if a national leader has every single penny of investment wealth positioned to not pay any income tax . . . even if it is legal?

If the national leader simply wanted the tax result, he/she could park money in a U.S. brokerage account. But, the problem with that is the IRS has income information sharing agreements with just about every country. So, the hometown crowd will know that the leader is positioning money to avoid any income tax. Bad for reelection.

So, if there happens to be a jurisdiction that maintains bank secrecy laws and might not share income information with other tax authorities, you go there. Thus, the reason for using Panama is not simply to obtain a particular tax result – you can get that result in the U.S. The reason is so that no one back home knows that you’re obtaining that particular tax result.

Now, as for U.S. persons, for decades, foreign trusts have been a matter of move and counter-move.