Fitch Ratings-New York/San Salvador-15 March 2019: Panama’s bank regulators have increased capital and regulatory requirements through a series of reforms over the last several years, moving banks more in compliance with Basel III standards, which Fitch Ratings views positively from a credit perspective.

Panama adopted Basel III-related liquidity rules in 2018, with the liquidity coverage ratio (LCR) to be phased in by 2022. Most Fitch-rated banks already comply with this requirement, with LCRs above 100%. LCR and high quality liquid asset requirements are especially relevant given the absence of a central bank and deposit insurance. The authorities will also be establishing a USD500 million liquidity fund, to be managed by Banco Nacional de Panama.

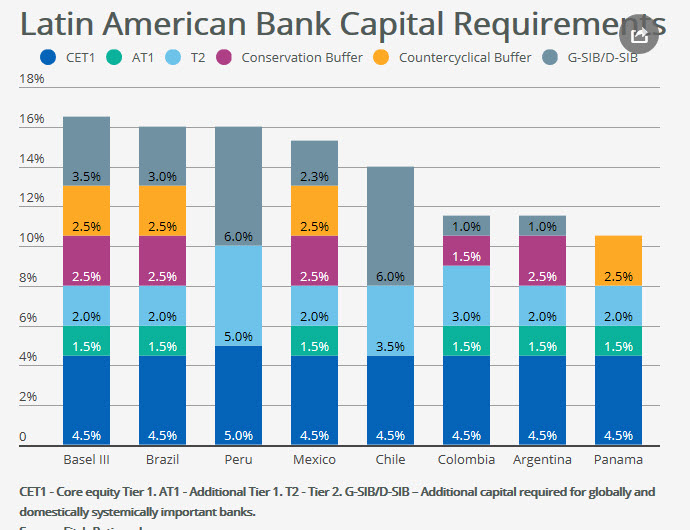

The regulators have yet to establish capital conservation buffers and additional capital requirements for domestic systemically important banks. However, most Panamanian banks should be able to meet the applicable capital buffer requirements given current capital levels. As of September 2018, domestic banking systems’ regulatory capital to risk-weighted assets ratio averaged 15.9%, with ratios for the four largest banks in terms of assets ranging from 13.5% to 19.8%.

As of September 2018, domestic banking systems’ dynamic provisions contributed 1.3% of risk-weighted assets, or USD988.7 million to their countercyclical capital buffers versus the 2.5% requirement. Implementation of IFRS9 standards increased provisioning; capital requirements will incorporate operational and market risk for trading assets in 2019. However, Panamanian banks maintain relatively small and simple trading portfolios, with loans representing nearly 70% of earning assets where most of the interest rate risk relies.

Panama’s bank regulators have increased capital and regulatory requirements through a series of reforms over the last several years, moving banks more in compliance with Basel III standards, which Fitch Ratings views positively from a credit perspective.

Despite potentially lower credit growth, Fitch expects Panamanian banks’ financial performance to remain resilient. While impaired loans will likely increase, these will remain at comparatively low levels at around 2%. Fitch expects Panama’s economy to recover in 2019, which could slightly boost credit demand and improve bank profitability and returns.

Even with the heightened regulatory burden, Fitch expects Panama’s banking industry to remain highly competitive, with 48 domestic banks currently serving the Panamanian market. Increased regulatory and capital standards may spur consolidation of the banking industry as economies of scale become more important given rising funding and operating costs amid greater competition.

In Fitch’s view, the regulatory framework and capital adequacy in Panama’s financial system is reasonable and commensurate with its risk profile. Currently, the Rating Outlook is Stable on 90% of the 10 Fitch-rated banks’ long-term IDRs. However, risks remain regarding bolstering adequate supervision and the implementation of the recommendations of the Financial Action Task Force of Latin America (FATF) to avoid being categorized as a non-cooperative jurisdiction. FATF stated in early 2018 that Panama was largely compliant with 35 of 40 recommendations, up from five in2012. In early 2019, the legislative assembly also approved the criminalization of tax evasion.

By a unanimous vote of the EU bloc’s 28 countries, member states recently blocked the publication of a blacklist including Panama as part of a list of countries with deficiencies in anti-money laundering (AML) and counter-terrorist financing (CTF) frameworks, after being removed from the blacklist in 2018. On March 12, the EU added 10 jurisdictions to the updated list, which did not include Panama. According to the Basel AML Index, Panama ranked 34 out of 129 most exposed countries.

If any list were to be approved, it would be more of a potential credit negative for the 25 Panamanian offshore banks relying on foreign-sourced funds and some of the foreign banks (30 banks) with low deposit franchises domestically. As of September 2018, close to 85% of wholesale funding was provided by foreign entities (15% of total funding), which also are the source of 29% of deposits and 32% of bank assets. Correspondent banks that are used by domestic banks to service foreign transactions have undertaken a de-risking process since 2015-2016, after Panama lost 64 banking relationships. However, the country has since established 82 new relationships.