With steady growth and reaching up to $1 billion a year, this financing mechanism is controlled by 24 companies, mostly banks.

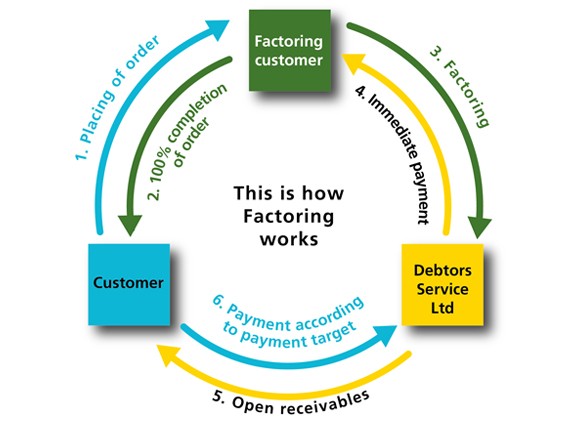

Every year, the activity records growth of between 10% and 20%. “Using a factoring contract, a trader or manufacturer can assign an invoice or other credit document to a factoring company in exchange for a full or partial financial advance” explains an article in Panamaamerica.com.pa.

According to Joaquin Rodriguez, Vice President of Factoring and Finance at Global Bank, any company which has accounts receivable, as long as it’s client has a demonstrable ability to pay, is a potential user of this product.

Meanwhile, Aileen Nuñez, manager of Factoring and the Business Segment at BBVA Panama, said companies which discount their bills belong to various sectors, examples being industrial, construction and services which have been contracted by the Government or by the private sector.

“We all know that in Panama works by the State are on the increase, and because the economy is more stable and dynamic, there are more projects for housing developments, hydroelectricity and mining companies, more companies are entering the market of imports and exports, therefore there are more clients for factoring services,” said Ariadna Larissa Sandoval, Factoring manager at Multibank .

“Banks that offer factoring services are supervised by the Superintendency of Banks of Panama, and this body checks and inspects factoring transactions in the same way that it reviews other forms of credit managed by banks, according to the parameters established in the agreement on Credit Risk,” explained Alexis Arjona, general manager of Banco Aliado.

Source: Panamaamerica.com.pa