In Panama, was approved a new law that extends the scope of the Special Free Port System for the province of Colon, through the exclusion of tax payments for the import of goods, both for domestic and non-domestic.

From the statement of the National Assembly:

In the third debate, the National Assembly approved the optimization of the Special Free Port System for the province of Colón (SEPLC) through the exclusion of tax payments for the import of goods, both for domestic and non-domestic.

Project 684 amends Law 29 of 1992, which was created by SEPLC, in such a way that these goods are exempt from import duties or taxes, from the tax on the transfer of movable tangible goods and the provision of services, as well as from the selective consumption tax (lSC) and may only be imported into the national fiscal territory.

The proposal allows tax credits to be granted as an incentive to strengthen the commercial investment in the sixteen (16) streets of the city of Colon and Colon 2000.

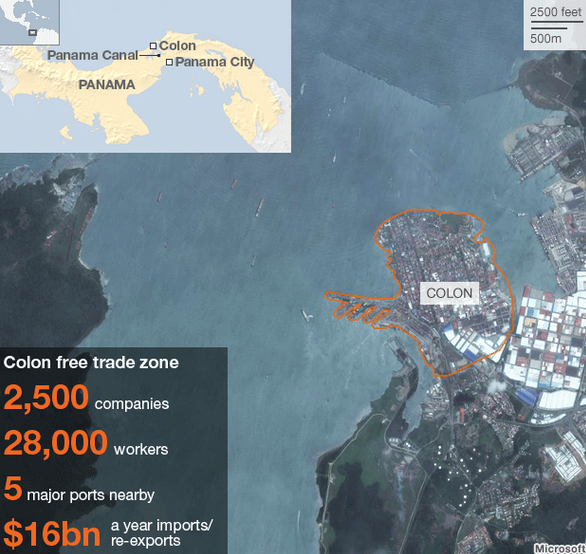

Through these regulations, a special fiscal and customs system is established with a Free Port structure applicable to the territory of the province of Colon, especially the Island of Manzanillo, except for the areas subject to the Free Zone.

Such tax credit shall be used exclusively by the respective taxpayer for the payment of import taxes, up to a maximum term of three hundred and sixty-five calendar days counted from the date on which the respective document is approved.