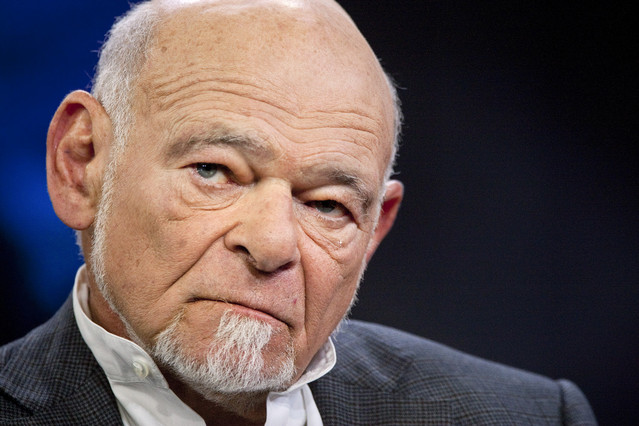

Here is a great BLOOMBERG report about a man who sold at the top and often buys at the bottom, Sam Zell, aka “The Grave Dancer”. You need to know that even while Panama hits her stride, Columbia is another place to watch right now.

By Prashant Gopal, Brian Louis and Betty Liu – Aug 30, 2011 12:37 PM ET

Billionaire Sam Zell said he is entering the real estate markets in Colombia and India in the next two weeks as he continues to favor international investments over U.S. property deals.

Zell, chairman of Chicago-based Equity International, will invest in real estate in Colombia and will eventually move on to residential projects, he said in an interview today on Bloomberg Television. In India, he plans to open hotels.

“Colombia is the next star of Latin America,” Zell said on “In the Loop” with Betty Liu. “In India, we’re doing a hotel/motel program like Residence Inn at Marriott and we hope to build a chain across the country.”

Zell, through Equity International, which he co-founded with Gary Garrabrant in 1999, has invested in real estate- related companies around the world, including in Brazil, China and Mexico. His involvement in the U.S. property market is “minimal” amid low interest rates and inflation that he estimates to be as high as 6 percent, Zell said.

Equity International’s first deal in Colombia is a $75 million investment in Bogota-based Terranum Development, a closely held real estate company, according to a statement today. Terranum is developing a 190,000-square-meter (2 million- square-foot) mixed-use complex near Bogota’s El Dorado International airport, the companies said.

Equity Office Sale

Zell, 69, sold his Equity Office Properties Trust in 2007 for $39 billion as the real estate market was peaking. U.S. commercial property prices fell as much as 49 percent from their October 2007 high after credit contracted and the economic slump boosted the unemployment rate to more than 9 percent, according to the Moody’s/REAL Commercial Property Price Index.

Commercial real estate prices climbed 0.9 percent in June, the third straight monthly gain, according to Moody’s. The increase represented a “firming up” of the market bottom as investors move beyond trophy properties and major coastal cities, the company said Aug. 22.

Equity International said earlier this month that it sold its remaining stake in Gafisa SA after previously owning as much as 23 percent of the Sao Paulo-based homebuilder. The investment firm still has five portfolio companies in Brazil and wants to expand in Latin America’s biggest economy, Garrabrant said in an Aug. 2 statement.

Brazil is still “really terrific” even after a 21 percent decline in the benchmark Bovespa stock index this year, Zell said.