Telecoms entrepreneur Wang Jing, 42, listed among world’s 200 richest people with net worth of US$10.2 billion in June, is now worth only US$1.1 billion, says Bloomberg Billionaires Index.

The Chinese billionaire who is using his personal fortune to help fund a US$50 billion Nicaraguan challenger to the Panama Canal has seen his net worth tumble following the equity market slump in the world’s second-largest economy.

Telecommunications entrepreneur Wang Jing, 42, was listed among the world’s 200 richest people with a net worth of US$10.2 billion at the peak of the Chinese markets in June, according to the Bloomberg Billionaires Index.

However, following the fall in the stock market his net worth has since fallen to only US$1.1 billion.

Wang’s 84 per cent drop so far in 2015 is the worst recorded by the index, which provides a daily ranking of the world’s 400 richest people.

The Hong Kong-based developer, HK Nicaragua Canal Development Investment Group (HKND), led by Wang, said in 2014 that the canal would be operational by 2020.

However, one risk adviser said the decline in Wang’s fortune could raise questions about whether the canal remained a viable proposition.

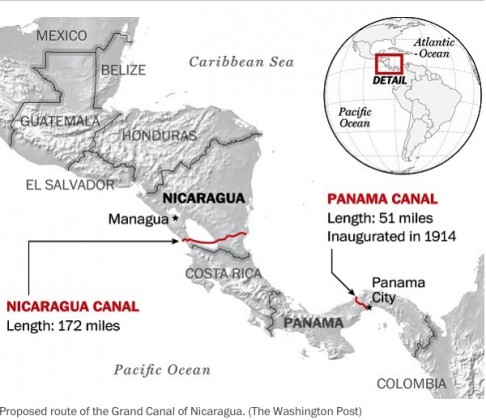

Work started in July 2014 on the 278km canal, which will open a route between the Pacific Ocean and the Caribbean Sea.

The canal could give China a major foothold in Central America, a region long dominated by the United States.

However, protesters in Nicaragua claim the project will hurt the environment.

HKND was awarded a 50-year concession for the 274km canal by the Nicaraguan government of President Daniel Ortega in 2013.

The billionaire said in December 2014 that he was committing personal funds to the project, and had invested about US$500 million of his own money into it so far, Peng Guowei, an executive vice-president at HKND, told the Xinhua news agency on September 7.

“The turn of fortune in Wang’s financial resources will impact on how and whether the canal can and will be built,” said Daniel Wagner, chief executive of the US risk advisory firm, Country Risk Solutions.

“I would expect, given this year’s financial gyrations in China, that the government is also asking itself whether the canal is a viable proposition.”

However, HKND said that despite the economic setbacks and local protests against the canal’s construction, the project was moving forward.

“I have no doubt that appropriate financial arrangements will be in place before construction commences,” said Bill Wild, HKND’s chief adviser for the canal.

Ivan Glasenberg, chief executive of the Swiss company, Glencore had the second-biggest percentage decline, falling 66 per cent to US$1.8 billion.

Wang owns 35 per cent of publicly traded Beijing Xinwei Telecom Technology Group, which has tumbled along with China’s equity markets. The end of a lock-up on 51 per cent of its shares on September 10 triggered a further decline that has pushed Xinwei to a 57 per cent drop this year.

He pledged Xinwei shares valued at US$2.4 billion in July that were removed from his net worth calculation.

Behind Wang and Glasenberg are Hong Kong casino operator Lui Che-Woo and Mexican retailer Ricardo Salinas, who have both fallen almost 47 per cent.

To date, the year’s biggest dollar decliners are the world’s third- and fourth-richest people.

Carlos Slim, ranked number four, has lost US$14.2 billion, or 20 per cent of his net worth. Warren Buffett is down US$12.5 billion, a 17 per cent fall. The 400 billionaires on the index have lost 4.2 per cent of their combined net worth this year.

HKND said in September that the funds raised from the pledged Xinwei shares were used for Wang’s “personal investments” and not for the canal project, without elaborating.

Wang is also funding unrelated projects – in some cases with partners – including a deep water port in Ukraine. HKND also said in September it was gathering a group of investors to back the effort with plans to sell shares, possibly even an initial public offering, and that it would shore up financing for the canal by “putting into play our imagination and creativity”.

Wang has yet to say whether banks might help with the financing.

Francisco Mayorga, an economist who was Nicaragua’s central bank governor in the 1990s, said HKND would eventually be able to raise funding once the engineering and impact studies were complete.

HKND said in August that it would start to seek bids on the canal’s final design after the Nicaraguan government approved the environmental review.

“Wang will probably be able to find enough venture capitalists to launch the project and resort to the services of one of the leading investment banks of the world to structure an offer that may enable him to raise the rest of the funds in a sound combination of equity and debt,” said Mayorga, who is an adviser to the board of the Inter American Development Bank.