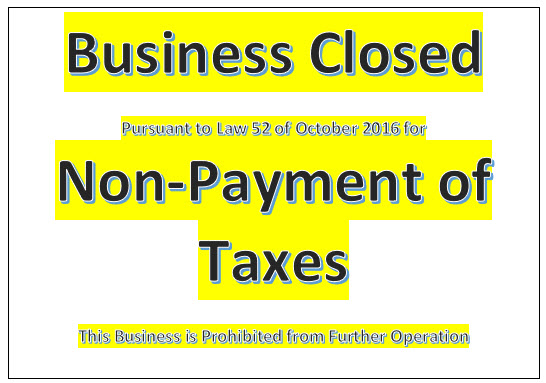

So our Tax office, the DGI is applying the provisions of Law 52 of October 2016 and this represents more onerous fines and the suspension of the rights of a company or foundation in the Public Registry. In case of having three consecutive periods without paying the Tasa Unica, the DGI will send a note to the Public Registry, where the suspension of all the corporate rights of the legal entity is ordered.

Now even if I pay the fine and the fees, I still cannot pay taxes due on the sale and transfer of property owned by the corporation. Hmmm, a tax office that does not want to collect taxes. I plead innocent and stand in line to pay the taxes but I find that the tax office operates behind closed doors and does not care about the tax payers in this country!!

The deadline for the payment of the Tasa Unica for Corporations and Private Interest Foundations expires on January 15 and July 15 of each year so you need to keep this current or you could loose the right to sell your property if it is owned by a corporation until the embargo is lifted.

The reactivation process will have a fine of $1,000, in addition to the surcharges of $300 per year after two consecutive years of not paying the taxes. This reactivation process can take an average of at least two months, which would make it impossible to carry out any type of transaction involving said legal entity including the sale and transfer of property owned by the corporation.